Investors are shorting oil sales, Indicating they are expecting $100 oil to be short lived.

As oil prices soared over the last few months, short sellers pounced on energy companies, Axios’ Kate Marino writes.

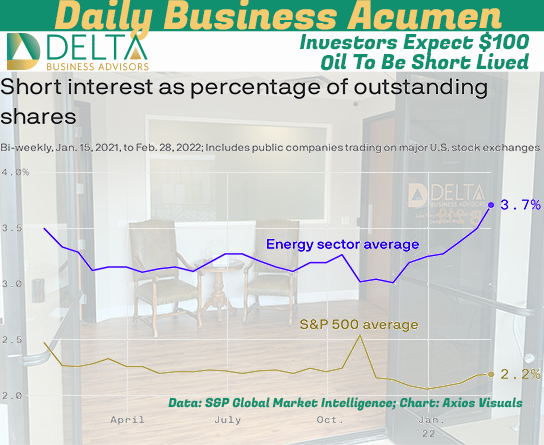

What’s happening: Changes in the percentage of short interest in energy companies largely tracked with shorts of all S&P 500 companies for much of last year.

That changed around January as U.S. oil prices pushed into the $80s — and energy stocks outperformed, logging a 33% year-to-date rise through mid-March compared to the S&P’s 12% decline.

Energy shorts shot up, diverging from the S&P average.

“Short sellers boosted their bets against energy stocks … speculating that the days of $100 per barrel oil will be short-lived,” wrote S&P Global Market Intelligence in a research note. The oil price rise has already tailed off, at least for now. After peaking at $124 per barrel last week, it rapidly retreated to sub-$100 levels.

Axios Markets By Emily Peck and Matt Phillips ·Mar 18, 2022