So, you’re ready to take the leap and sell your business. You’ve got your M&A advisor by your side, your financials are in order, and you’re feeling pretty confident. But here’s a startling fact: only half of businesses actually succeed in selling, even with a qualified advisor in the picture.

According to the quarterly Market Pulse Report from the International Business Brokers Association and the M&A Source, approximately 50% of deals end without a successful sale. Keep in mind, these are professionals who are dedicated to their craft and have invested in their careers.

In reality, experts estimate that the actual closing rate for small and medium businesses is closer to 25-30%. This includes business owners who attempt to sell on their own, as well as those who list with real estate agents, lawyers, and other “hobbyist” M&A advisors.

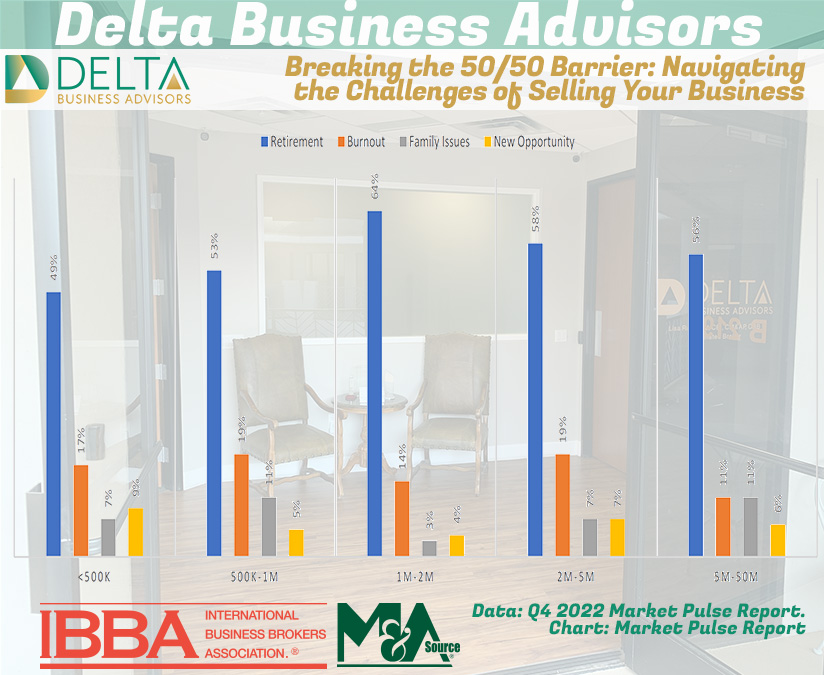

So, why is the failure rate so high? Let’s break it down by sector, based on insights from advisors in the Q4 2022 Market Pulse Report:

Main Street Challenges: Financials and Financing

In the Main Street market, which encompasses businesses valued at less than $2 million, poor financials and financing issues are the leading culprits behind unsuccessful sales. Sometimes, a business isn’t performing well due to various factors like economic fluctuations, market bubbles, or even unexpected events like a pandemic. However, some sellers hold on for too long, waiting until they’re burned out or until the business has outgrown their skill set.

Ideally, you’ll get the best value for your business when it’s on an upward growth trend. Once a business starts declining, it becomes increasingly challenging (sometimes impossible) to find buyers.

Financing is another hurdle in the Main Street market. Banks typically prefer to lend against tangible assets rather than cash flow, and individual buyers often struggle to secure the necessary capital. This creates a gray area in the upper end of the market unless the deal qualifies for an SBA loan.

A small business is a lifestyle business for many owners, generating a sufficient income. Meanwhile, many buyers in this market are looking to “buy a job.” However, many of these businesses do not generate enough profit for the buyer to both earn a living and pay the debt service. These deals are tough to get done.

Unrealistic Expectations in the Lower Middle Market

In the lower middle market, where businesses are valued between $2 million and $50 million, seller expectations become a significant concern. Some sellers firmly believe their business is worth more than what the market will bear. When advisors can’t fulfill these lofty expectations, the engagement terminates.

Ideally, advisors should avoid taking on these deals altogether. Testing the market with unrealistic expectations can have detrimental consequences. It can exhaust potential buyers, jeopardize confidentiality, and weaken your own motivation to keep the business performing.

Remember, the market ultimately determines the value, not what you personally want or need from the business. It’s crucial to trust your advisor and the process they’re leading. If they’re attracting a large pool of capable buyers, then you’re likely getting a true reflection of the demand for your business and its value.

Economic Uncertainty Adds Complexity

For both Main Street and the lower middle market, economic uncertainty emerged as the second leading cause of failed deals. Just a few months ago, we saw rising inflation and economists warning of a potential recession in 2023 (now they’re predicting a “shallow” downturn in 2024).

During uncertain times, deals can become shaky. While perfect businesses may still manage to close transactions, those with any complications may face challenges with lending. Equity shortfalls can lead to price adjustments and sour feelings. In some cases, buyers hit the pause button as they wait to see how the economy will unfold.

Plan Ahead for a Successful Sale

Understanding the reasons behind failed business sales is essential. Poor financials, financing roadblocks, risk conditions, delays, and unrealistic expectations all contribute to the difficulties. As a business owner, it’s crucial to regularly assess the value of your business, so you have a clear understanding of its worth and can take steps to increase that value for a future sale.

Advance planning, informed decision-making, and the right advisor can significantly enhance your chances of success. While deals can sometimes fall apart for various reasons and market conditions can change rapidly, with the right mindset and preparation, you can position yourself on the favorable side of that 50/50 statistic. Don’t let uncertainty hold you back. Take charge, strategize, and make informed decisions to achieve a successful sale and embark on new entrepreneurial endeavors.