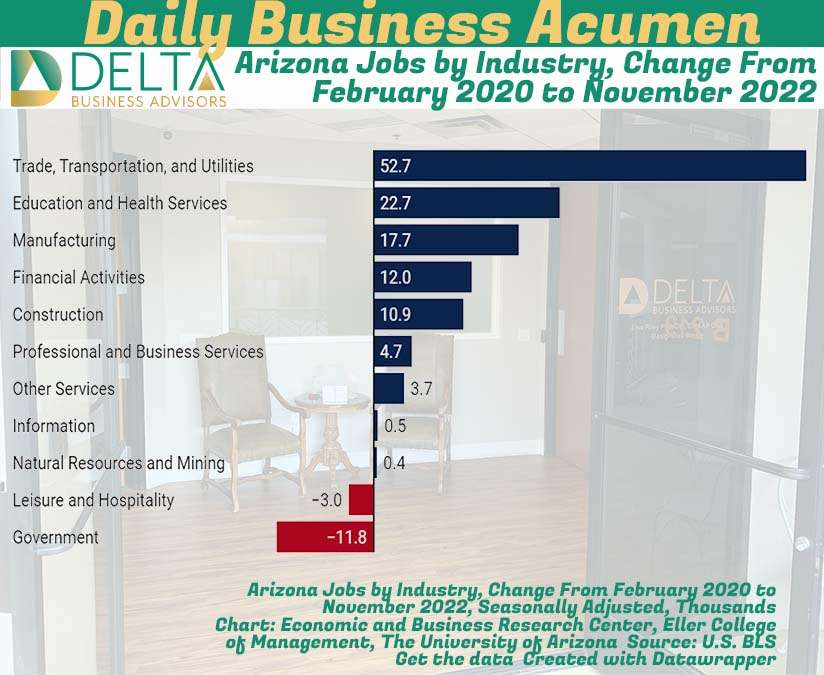

There is still strong job growth in Arizona and a majority of that is in Trade, transport, and utilities, and Education and Health Services. Mining down due to political pressures.

In November, job growth was driven primarily by education and health services (+4,000), government (+1,600), and leisure and hospitality (+1,500). Professional and business services, manufacturing, financial activities, other services, and natural resources and mining posted smaller gains. In contrast, trade, transportation, and utilities jobs declined by 1,800 over the month with losses concentrated in retail trade. Information posted small losses while construction jobs were stable over the month.

Nearly all Arizona major industries have recovered all of the jobs lost during the first two months of the pandemic. As of November, the two exceptions were government (-11,800) and leisure and hospitality (-3,000). Within government, the largest losses remained in local government (-9,800) followed by state government (-2,300). Federal government jobs were up 300. Within leisure and hospitality, the largest losses remained in accommodation and food services (-5,200). Jobs in arts, entertainment, and recreation were above their February 2020 level.

From February 2020 to November 2022, the pattern of job growth by industry in Phoenix was similar to the state. As usual, the pattern is different in Tucson, where job gains in trade, transportation, and utilities were offset by losses in professional and business services. Manufacturing jobs in Tucson have increased since the early days of the pandemic and were up by 2,000 in November. Education and health services jobs have also increased. Jobs remain below pre-pandemic levels in government, leisure and hospitality, information, and construction. Jobs in other services, financial activities, and natural resources and mining are near pre-pandemic levels.

The professional and business services sector in Tucson remains far below its pre-pandemic level, while statewide and in Phoenix it has more than recovered. The gap in Tucson is primarily due to losses in a sector that includes call centers, employment agencies, and services to buildings (like janitorial services). It is not clear what is driving this result in the data, but it may be related to shifts in employment practices within the industry that have caused these jobs to no longer be counted in the Tucson establishment survey.

Arizona Jobs Trended Up in November

George Hammond, EBRC Director and Research Professor