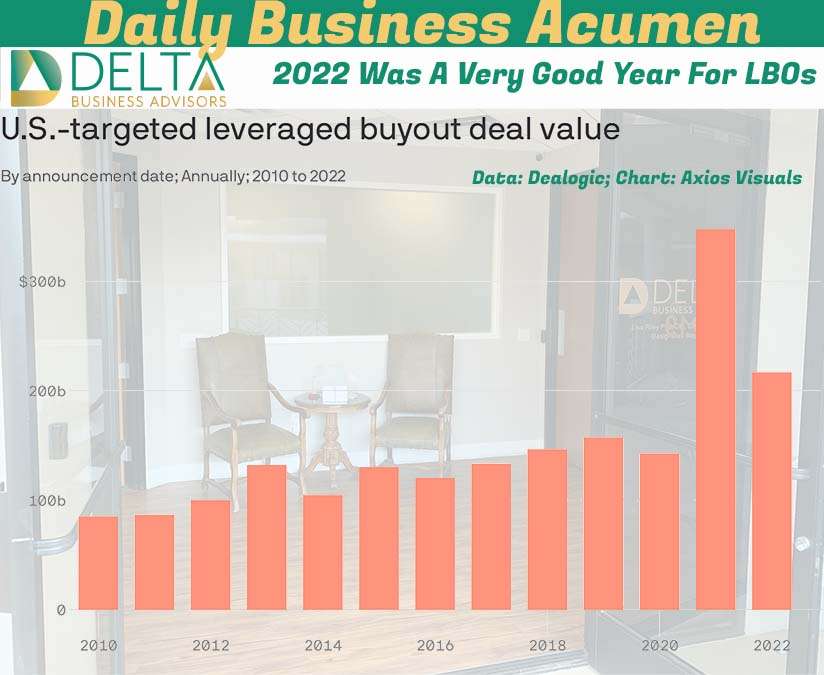

Even if 2022 didn’t come close to 2021, it was still a very good year with over $200 billion in LBO deals. The second largest amount of deals in the past 10 years. A leveraged buyout (LBO) is the acquisition of another company using a significant amount of borrowed money (bonds or loans) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company.

One of the big stories of 2022 was the collapse in deal activity. IPOs, M&A, and corporate bond deals all shriveled as rising rates and economic uncertainty clobbered markets, Axios’ Kate Marino writes.

- But, but, but: Remarkably, private equity buyouts just wrapped their second-busiest year in more than a decade — check out that chart above.

The big picture: This is one example of the explosive growth of private markets — for both equity and debt — a trend that was well underway even before the pandemic.

How it works: PE firms raise money from institutions and wealthy individuals, and in turn, use those funds as down payments to buy companies.

- They typically borrow heavily from investment banks to cover the rest of the purchase price for these deals, known as leveraged buyouts (LBOs) — just like a mortgage on a home.

By the numbers: PE deal volumes were, of course, down from 2021 — a year that may, in time, turn out to be a colossal Fed-driven anomaly. But last year’s U.S. deal value was still 61% higher than the pre-pandemic average (2013-2019).

What happened: PE funds are sitting on record dry powder that they need to deploy into deals — and public companies got a whole lot cheaper to scoop up during 2022’s bear market.

Axios Markets By Matt Phillips and Emily Peck · Jan 03, 2023

- Plus: Private debt funds stepped in to finance the deals when the corporate bond and bank loan market started to seize up around midyear.

- The private debt market “is definitely what kept LBO volume going in Q3 and Q4,” Susan Kasser, Neuberger Berman’s co-head of private credit, tells Axios.

- As PitchBook wrote last month: “Of the 26 take-privates announced in the US and Europe since early June 2022, not a single one has been funded by banks; they are relying instead on private debt funds or all-equity structures.”