With so many people locked into a very favorable mortgage rate, it may not make financial sense for them to sell. My first house loan had a rate of 6%.

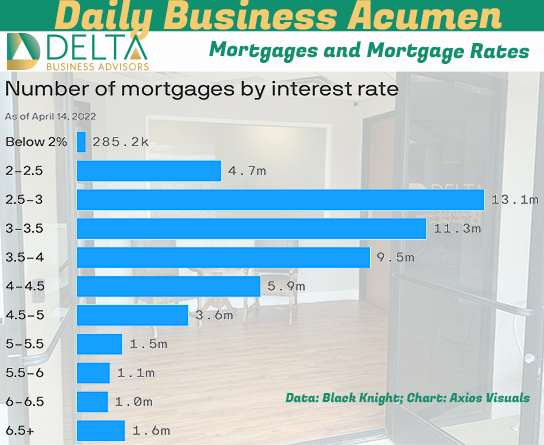

Nine out of ten American mortgages carry an interest rate of less than 5%, the official level at which most new 30-year fixed-rate mortgages are now being written, Axios’ Felix Salmon writes.

Why it matters: Houses are affordable — if you already own one. According to Fannie Mae’s most recent survey, 92% of homeowners say their current home is affordable. More impressively, 91% of lower-income homeowners say the same thing, up from 79% at the end of 2017.

Yes, but: Were those homeowners to move, they would need to pay substantially more in interest.

The big picture: If you hold a mortgage that’s cheaper than what you’d need to pay if you moved, that’s a significant incentive to stay put. The result is that thanks to supply-and-demand dynamics, increased mortgage rates are less likely to mean lower home prices.

Between the lines: When mortgage rates rise, that lowers the supply of homes hitting the market. Lower supply means higher prices, especially in areas where many buyers are bidding in cash.

The bottom line: Americans are holding onto their cars for much longer than they normally would because replacing them is so expensive. Something similar is beginning to happen in real estate, too.

Axios Markets By Matt Phillips and Emily Peck · Apr 18, 2022